TDG GOLD CORP. REPORTS NEAR SURFACE PORPHYRY-STYLE COPPER-GOLD AT BAKER AND EXTENDS HIGH-GRADE B-VEIN, TOODOGGONE

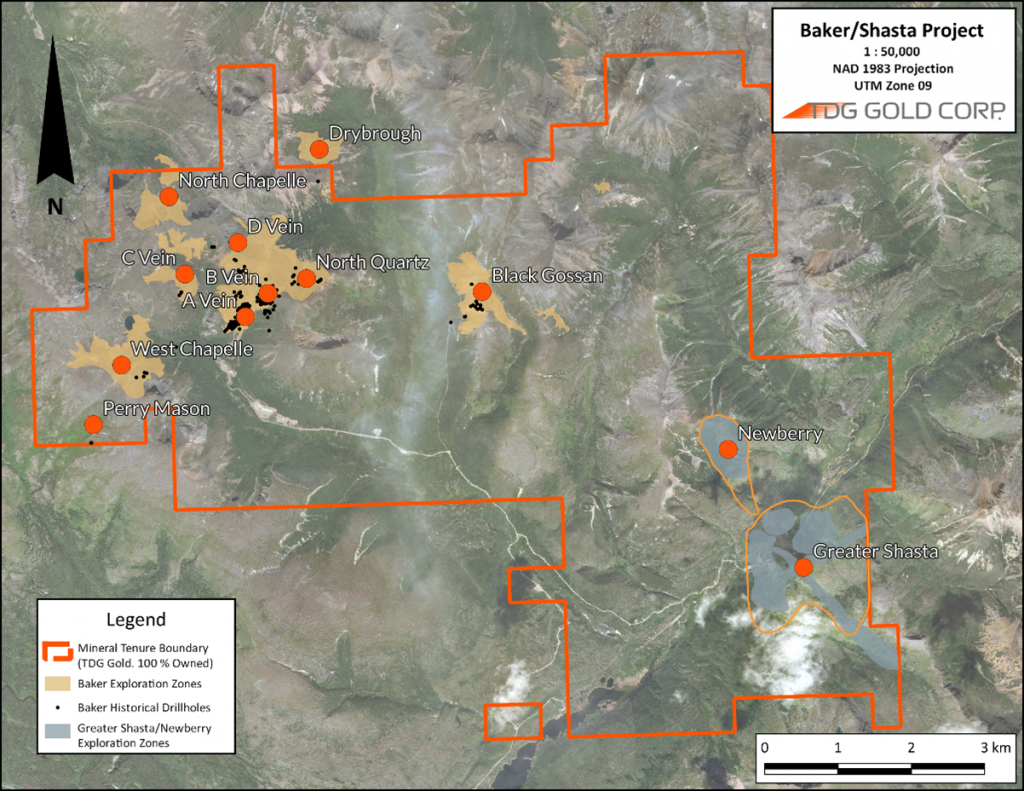

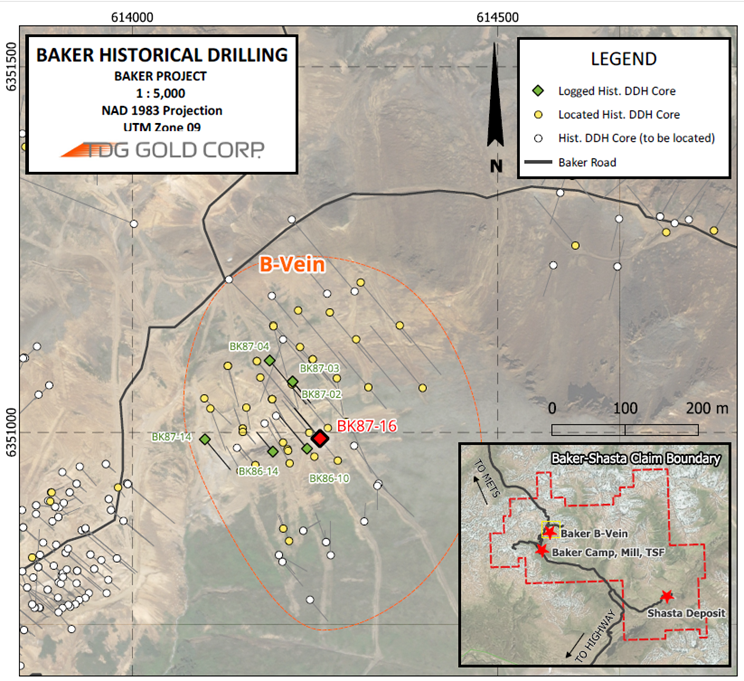

White Rock, British Columbia, July 25, 2023 – TDG Gold Corp. (TSXV: TDG) (the “Company” or “TDG”) is pleased to announce that the first hole from its relogging, resampling and assaying of historical core appears to support the concept that the Baker (Figure 1) area of its Toodoggone properties may represent a bulk-tonnage, porphyry-style copper-gold target that was later over-printed by high-grade epithermal gold mineralization. Historical hole BK87-16 was drilled in 1987 targeting high-grade gold-silver (“Au-Ag”) mineralization associated with the Baker B-Vein (Figure 2) that was the target of mining at that time, with ore milled at the nearby Baker mill. As a result, it was only sporadically sampled based on that target model. TDG’s relogging and resampling of the entire hole has not only confirmed the historical high-grade Au-Ag epithermal-style mineralization, extending this style of mineralization to depth and along strike of the historical mining, but has also identified porphyry-style copper-gold (“Cu-Au”) veining, alteration and mineralization comprised of bornite, chalcopyrite and molybdenite over more than 60 metres of core length starting from near surface and ending in mineralization.

The intercept comprises 0.1 % copper (“Cu”) and 0.7 grams per tonne (“g/t”) Gold (“Au”) over a 60.5 m intercept from 62.6 m down hole, including 0.27 % Cu and 2.1 g/t Au over 17.9 m from 98.2 m down hole (Table 1).

Steven Kramar, TDG’s VP Exploration, commented: “We are not aware of any detailed logging and sampling that has been focused on the porphyry-style copper-gold potential at Baker. These first assay results from resampling a single diamond drillhole completed at the Baker B-Vein in 1987, integrated with geophysical and geochemical data, validates the copper-gold potential at Baker. The drillhole was only drilled to a depth of 123 metres, which is deeper than most of the historical drill testing and ends in copper-gold mineralization.”

Table 1. Resample assay results from historical Baker B-Vein drillhole BK87-16.

| Drillhole | From | To | Length | Au | Ag | Cu | AuEq4 | CuEq4 | Mo | |

| (m) | (m) | (m) | (g/t) | (g/t) | (ppm) | (g/t) | (wt. %) | (ppm) | ||

| BK87-16 | 62.6 | 123.1 | 60.5 | 0.71 | 6 | 1,067 | 0.92 | 0.74 | 23.8 | |

| incl | 98.2 | 116.0 | 17.8 | 2.06 | 17 | 2,665 | 2.61 | 2.10 | 34.2 | |

| incl | 101.0 | 105.8 | 4.8 | 6.42 | 55 | 7,988 | 8.11 | 6.55 | 85.5 |

**Composite results were built using 0.1 g/t Au and/or 300 ppm Cu cut-off, although there may be intervals within the composite below 0.1 g/t Au and/or 300 ppm Cu.

***Calculated composites are truncated to significant 2 digits for Au/AuEq/CuEq and the nearest whole number for Ag/Cu (ppm).

****Calculated composites may not sum due to rounding.

4Gold Equivalent (AuEq) & Copper Equivalent (CuEq): Gold Equivalent and Copper Equivalent calculations reflect total gross metal content using US$ of $1,800/Oz Gold (Au), $22.50/Oz Silver (Ag) and $3.25/lb Copper (Cu) and have not been adjusted to reflect metallurgical recoveries. The above metal prices are approximately in line with the LME 3-year trailing average metal price. Gold Equivalent and Copper Equivalent is used for illustrative purposes to express the combined value of Au, Ag and Cu as a percentage of Au or Cu on an in situ basis. Calculations are uncut, and actual prices and recoveries (following metallurgical test work may differ from these assumptions which would change the equivalent value).

TDG’s 2023 Exploration Program at Baker

TDG is approaching Baker1 as a “back to basics” project with potential to host a bulk tonnage porphyry-style copper-gold deposit that is most likely located deeper than historically drilled holes. By relogging, resampling and assaying the historical core with a focus on identifying paragenesis of mineralized veins, TDG aims to use the new information to help identify vectors to potential porphyry targets for drill testing in 2024. In parallel with the historical core program, TDG has begun an extensive and intensive stream sediment sampling program across the Baker footprint focused on the potential for a porphyry target.

TDG’s historical core relogging, resampling and assaying program is low cost and aims to recover and resample as much as possible of the ~30,000 m of diamond drilling known to have been completed in 342 drillholes across the 15 square kilometre (“sq.km”) Baker project. The Baker historical core inventory is located at the Baker camp and mill site. So far, TDG has identified 91 complete/nearly complete drillholes for relogging, of which 41 are restacked and ready for logging, 8 have been fully relogged; and 3 have been submitted for assaying.

During the historical drilling that took place between 1974-2006, only ~15% of the drill cores are estimated to have been assayed for gold-silver5 and virtually none for any other elements, including copper5. TDG has noted the presence of porphyry-style veining and alteration and the occurrence of bornite (Cu5FeS4), chalcopyrite (CuFeS2) and molybdenite (MoS2) throughout the 8 drillholes logged so far. TDG has also noted a significant reduction in BK87-16 for the grades for gold and silver grades in resampled core compared to historical recorded results for the same hole – see Results Comparison section below.

Historical Baker Mine

Baker is a former producing, high-grade Au-Ag mine that operated intermittently from 1981-1997. Exploration efforts continued sporadically through to 2010. The focus of exploration historically was to identify high-grade epithermal Au-Ag veins for potential extraction and processing through the Baker mill, which originally included a copper circuit before being redesigned to process Shasta ore through to its closure in 2012. Baker is located adjacent to TDG’s Shasta resource stage, epithermal Au-Ag project and existing infrastructure consisting of mining road, historical mill and tailings storage facilities.

Baker B-Vein

The Baker B-Vein was the second zone where small-scale extraction took place at Baker1. Production records from mining at Baker noted approximately 17,500 tons of ore extracted from the B-Vein by Sable Resources at a grade of 0.9 ounce per ton (“opt”) Au, 5 opt Ag and 1 % Cu2. Over 8,400 m of historical diamond drilling2,3 is recorded at the B-Vein in 86 drillholes. Most historical assaying took place at the Baker mill laboratory2,3. A very low percentage (<5 %) of historical core from the B-Vein appears to have been assayed for copper, based on available assay certificates5.

The presence of chalcopyrite/bornite/molybdenite has been identified in multiple core samples targeting the B-Vein by TDG. This is the most common sulphide assemblage of primary Cu-Au porphyry deposits. Past academic studies support Baker mineralization having a component of magmatic water in addition to meteoric water in the hydrothermal fluid. The magmatic component of the hydrothermal fluid is suggestive of the influence of a porphyry system at depth.

By systematically relogging the historical core, including drillholes where extraction is known to have taken place, followed by resampling where appropriate, TDG is aiming to assemble the first comprehensive copper-focused drill database for Baker and to select drill-ready targets for 2024.

Chris Dail, a technical consultant leading TDG’s regional program, commented: “There were some truly spectacular gold-silver intercepts reported in the historical drill logs across Baker. The widespread nature of these intercepts, albeit with sporadic assaying, with a copper signature, hints at a much bigger porphyry system nearby. The only way forward is back to basics but we’re fortunate to have access to the inventory of historical core that we can methodically work through.”

Alteration/Mineralization

The core exhibited multiple generations of veining (Figure 3) associated with bornite, chalcopyrite and molybdenite cross-cutting pervasive pyrite + sericite (phyllic) alteration in the rock matrix (Figure 4). The phyllic alteration and sporadic potassic alteration cross-cut earlier epidote + magnetite alteration and veining. These porphyry assemblages, represented by the 62.6 m mineralized intercept (Table 1, 0.91 g.t AuEq4 / 0.74 % CuEq4), are crosscut by high-grade intermediate sulphidation epithermal veins, represented by the 4.8 m intercept (Table 1, 8.11 g/t AuEq4 / 6.55 CuEq4). This is suggestive that an earlier porphyry event was overprinted by a later epithermal system and historical efforts focused on the epithermal potential whereas the porphyry potential appears to have been underappreciated. Alteration was generally pervasive throughout the entire drillhole, with alteration and mineralization increasing with depth. A noticeable structural break suggests a fault-bounded mineralized bottom half (> 60 m, downhole) of the drillhole where mineralization and alteration increase abruptly, and the drillhole ends in moderate Au+Cu mineralization: 3.1 m of 0.07 % Cu, 0.21 g/t Au and 6 g/t Ag from 120.0-123.1 m depth (0.32 g/t AuEq4 or 0.26 % CuEq4).

Results Comparison: 2023 assays from resampling versus historical recorded assays

Historically recorded results for the same diamond drillhole (BK87-16) are presented in Table 2.

Table 2. Historically Recorded Results for Baker B-Vein Drillhole BK87-16.

| Drillhole | From | To | Length | Au | Ag | Cu | AuEq4 | CuEq4 | Mo |

| (m) | (m) | (m) | (g/t) | (g/t) | (ppm) | (g/t) | (wt. %) | (ppm) | |

| BK87-16 | 62.6 | 123.1 | Historical Assay Interval Incomplete – Not Able to Composite a Result | ||||||

| incl | 98.2 | 116.4 | 18.3 | 2.85 | 28 | 2,992 | 3.57 | 2.88 | N/A |

| incl | 101.2 | 105.5 | 4.8 | 10.64 | 105 | 11,656 | 13.40 | 10.82 | N/A |

**Composite results were built using the same assay intervals as Table 1.

***Calculated composites are truncated to significant 2 digits for Au/AuEq/CuEq and the nearest whole number for Ag/Cu(ppm).

****Calculated composites may not sum due to rounding errors.

4Gold Equivalent (AuEq) & Copper Equivalent (CuEq): Gold Equivalent and Copper Equivalent calculations reflect total gross metal content using US$ of $1,800/Oz Gold (Au), $22.50/Oz Silver (Ag) and $3.25/lb Copper (Cu) and have not been adjusted to reflect metallurgical recoveries. The above metal prices are approximately in line with the LME 3-year trailing average metal price. Gold Equivalent and Copper Equivalent is used for illustrative purposes to express the combined value of Au, Ag and Cu as a percentage of Au or Cu on an in situ basis. Calculations are uncut, and actual prices and recoveries (following metallurgical test work may differ from these assumptions which would change the equivalent value).

Historically selected sample intervals may differ from assayed intervals of resampled core for logistical and scientific reasons. The results of the assaying of resampled core by TDG indicate significantly lower grades compared to the historically2,3 published results for Au (-28 %) and Ag (-40 %), and Cu (-11 %). Differences could be due to a combination of historical effects including: sample selection methodology, a nugget effect, and/or laboratory methodology particularly for assay results generated by the historical Baker mill laboratory2,3.

QA/QC

Samples for the Baker 2023 core relogging program were handled via rigorous chain of custody, between collection, processing, and delivery to the ALS laboratory in North Vancouver, B.C. The historic drill cores were stored by previous operators in a core storage yard near the Baker Mill. TDG staff recovered and inventoried the historic core and compared and validated the recovered core against historic core logs, box labels and core blocks. The core was subsequently relogged, photographed and sampled at TDG’s Baker Mine site and processed by geologists and technicians. Quality assurance and control (“QAQC”) materials were inserted into the sampling sequence during geological sample selection. The drill core was selected for sampling and placed in zip-tied polyurethane bags, then in security-sealed rice bags before being delivered directly from the Baker Mine site, to Bandstra Transportation Systems in Prince George, B.C., and transported to ALS’ preparation facility in Kamloops, B.C., and ultimately to the ALS laboratory in North Vancouver, B.C. Samples were prepared and analyzed following procedures Au-GRA21 for Au and ME-ICP61 for trace elements. Overlimit concentrations of precious or base metals were analyzed (where applicable) by Au-GRA22, Ag-GRA22, and Cu-OG21 for Au, Ag and Cu respectively. Information about methodology can be found on the ALS Global website, in the analytical guide (here).

QAQC is maintained internally at the lab through rigorous use of internal certified reference materials, blanks, and duplicates. An additional QAQC program was administered by TDG through the verification of lab results via use of certified reference materials (“CRMs”) and blank (unmineralized) samples that were blindly inserted into the sample batch. If a QAQC sample returns an unacceptable value an investigation into the results is triggered and when deemed necessary, the samples that were tested in the batch with the failed QAQC sample are re-tested.

BK87-16 utilized NQ size for drill core. During the resampling process, the entire remaining drill core was consumed (either the second half of the remaining material, or the entire remaining unsampled material) due to the small diameter of the core. The historical collar location was verified by handheld GPS and will be sited utilizing a more precise DGPS in due course. Table 3 presents the drillhole particulars.

Table 3. BK87-16 Drillhole Particulars

| HOLE | UTME (NAD83) | UTMN (NAD83) | Azimuth(°) | Dip(°) | Final Depth (m) |

| BK87-16 | 614,257 | 6,350,991 | 320 | -64 | 123.4 |

Qualified Persons

The geologically related technical content of this new release has been reviewed and approved by Steven Kramar, P.Geo., Vice President, Exploration for TDG and a Qualified Person, as defined under National Instrument 43-101.

1Mineral Exploration/Exploration Target Area(s): TDG is a mineral exploration focused company and the Company’s Projects are in the mineral exploration stage only. The degree of risk increases substantially where an issuer’s properties are in the mineral exploration stage as opposed to the development or operational stage. Exploration Targets and/or Exploration zones are speculative and there is no certainty that any future work or evaluation will lead to the definition of a mineral resource.

2Historical Data: This news release includes historical information that has been reviewed by TDG’s qualified person (QP). TDG’s review of the historical records and information reasonably substantiate the validity of the information presented in this news release; however, TDG cannot directly verify the accuracy of the historical data, including (but not limited to) the procedures used for sample collection and analysis. Therefore, any conclusions or interpretations borne from use of this data should be considered too speculative to suggest that additional exploration will result in mineral resource delineation. TDG encourages readers to exercise appropriate caution when evaluating these data and/or results.

3Historical Drill Core Sampling & Assay Methodology: Historical core was geologically logged with lithologies identified and notable geological features recorded. Historical core was split in half (and in rare cases sawn in half) along sample intervals (lithology and mineralization dependant) generally less than 3 m. Chemical analysis was performed dominantly for precious metal analysis (Au, and Ag), and infrequently for base metals (Pb, Zn, Cu), and rarely for major elements and trace elements. Historically, different commercial laboratories were utilized in addition to an assay lab at Baker Mine Site. These lab facilities may or may not have had accreditation and in all cases accreditation (if applicable) pre-dated current ISO standards. Over that period, a variety of digestion and assay methods were used, including atomic absorption, fire assay atomic absorption, aqua regia atomic absorption and aqua regia ICP with varying detection limits. Reference materials (if any) were inserted at the analytical level and thus were unblind to the facility processing the samples.

4Gold Equivalent (AuEq) & Copper Equivalent (CuEq): Gold Equivalent and Copper Equivalent calculations reflect total gross metal content using US$ of $1,800/Oz Gold (Au), $22.50/Oz Silver (Ag) and $3.25/lb Copper (lb) and have not been adjusted to reflect metallurgical recoveries. The above metal prices are approximately in line with the LME 3-year trailing average metal price. Gold Equivalent and Copper Equivalent is used for illustrative purposes to express the combined value of Au, Ag and Cu as a percentage of Au or Cu on an in situ basis. Calculations are uncut, and actual prices and recoveries (following metallurgical test work may differ from these assumptions which would change the equivalent value.

5Unassayed Historical Drill Core: Historical drill core intersections, lengths or intervals referenced for re-assay or geological analysis may not be available or suitable for sampling. Historical drill cores were inherited with the project and TDG provides no guarantees or warranties that these drill cores are part of the historical inventory, are available and/or have not degraded to a state that would render them wholly unusable for the purposes of scientific investigation. TDG provides no warranties/guarantees that these historical un-assayed drill cores host precious or base metal mineralization.

Clarification on Closed Private Placement

The Company also wishes to confirm the total agent and finder compensation that it paid in connection with the brokered private placement of the Company that closed in two tranches, on April 26 and July 7, 2023. The Company paid an aggregate cash fee of $130,259 and granted 556,577 non-transferable broker warrants of the Company (each, a “Broker Warrant”) to Raymond James Ltd. and its syndicate of agents. Each Broker Warrant entitles the holder thereof to purchase one-half of one common share of the Company at an exercise price of $0.30 per share for a period of three years from the date of issuance. The Company also paid aggregate cash finders’ fees of $52,900 and granted 144,428 non-transferable finder warrants of the Company (each, a “Finder Warrant”) to arm’s length finders of the Company. Each Finder Warrant entitles the holder thereof to purchase one common share of the Company at an exercise price of $0.30 per share for a period of three years from the date of issuance.

About TDG Gold Corp.

TDG is a major mineral and placer tenure holder in the historical Toodoggone Production Corridor of north-central British Columbia, Canada, with over 23,000 hectares of brownfield and greenfield exploration opportunities under direct ownership or earn-in agreement. TDG’s flagship projects are the former producing, high-grade gold-silver Shasta and Baker mines, which produced intermittently between 1981-2012, and the high-grade gold-silver Mets development project, all which are all road accessible, and have over 65,000 m of historical4,5 drilling. The projects have been advanced through compilation of historical4 data, new geological mapping, geochemical and geophysical surveys and, at Shasta, 13,250 m of modern HQ drill testing of the known mineralization occurrences and their potential extensions. In May 2023, TDG published an updated Mineral Resource Estimate for Shasta (see TDG news release May 01, 2023) and which remains open at depth and along strike. In January 2023, TDG defined a larger exploration target area adjacent to Shasta (Greater Shasta-Newberry; see TDG news release January 25, 2023) with drill-ready targets where TDG aims to undertake follow-up exploration activities in 2023.

ON BEHALF OF THE BOARD

Fletcher Morgan

Chief Executive Officer

For further information contact:

TDG Gold Corp.,

Telephone: +1.604.536.2711

Email: info@tdggold.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward Looking Statements

This news release contains forward-looking statements that are based on the Company’s current expectations and estimates. Forward-looking statements are frequently characterized by words such as “suggest”, “potential”, “presence”, “significant”, “identify”, “vector”, “aim”, “represent”, “indicate”, “exhibit”, and variations of these words as well as other similar words or statements that certain events or conditions “could”, “may”, “would” or “will” occur. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that could cause actual events or results to differ materially from estimated or anticipated events or results implied or expressed in such forward-looking statements. Such factors include, among others: the actual results of current and planned exploration activities; the potential for a discovery of a porphyry Cu +/- Au or other style of mineral deposit with economic grade; results from future exploration programs; that geological and/or geophysical anomalies remain open (in any direction); conclusions of future economic evaluations; changes in project parameters as plans to continue to be refined; possible variations in grades of mineralization and/or future actual recovery rates; accidents, labour disputes and other risks of the mining industry; the availability of sufficient funding on terms acceptable to the company to complete the planned work programs; delays in obtaining governmental approvals or financing; and fluctuations in metal prices. There may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise. Forward-looking statements are not guarantees of future performance and accordingly undue reliance should not be put on such statements due to the inherent uncertainty therein.