TDG GOLD CORP. PROVIDES INITIAL METALLURGICAL TESTING RESULTS INCLUDING RECOVERY UP TO 94.8% GOLD AND 77.2% SILVER, SHASTA PROJECT, TOODOGGONE DISTRICT, B.C.

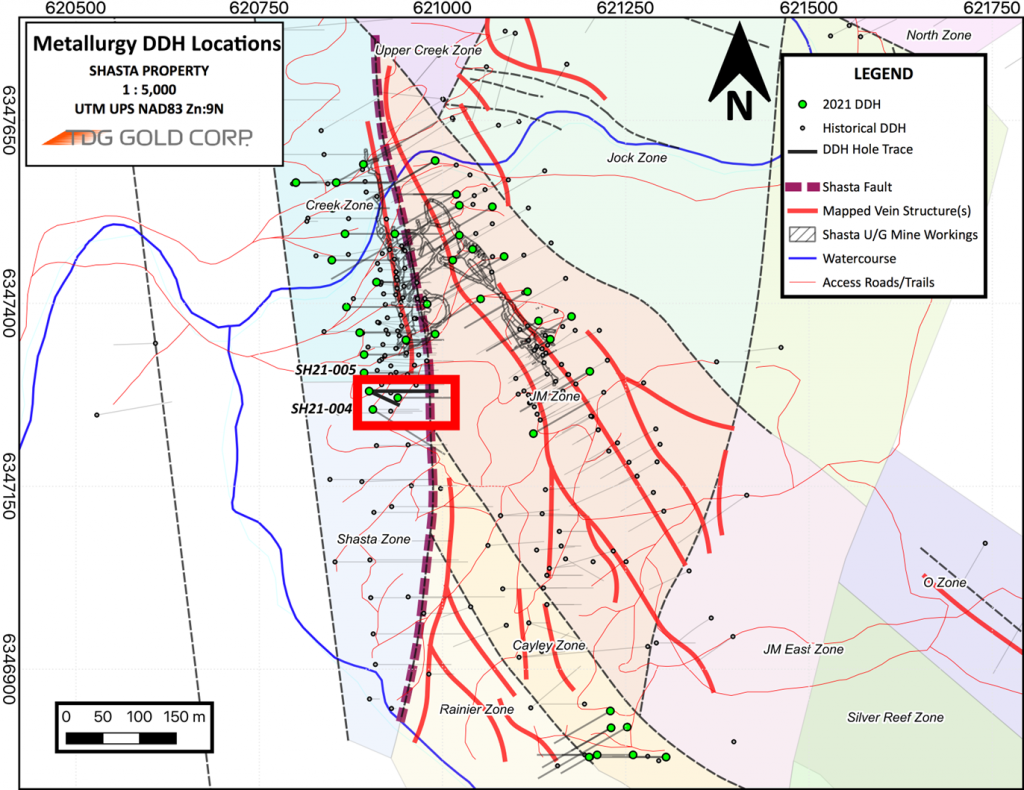

White Rock, British Columbia, May 02, 2022 – TDG Gold Corp – (TSXV: TDG) (the “Company” or “TDG”) is pleased to announce preliminary metallurgical results from two composite samples constructed from diamond drillholes SH21-004 and SH21-005 from the 2021 drilling program at its former producing gold-silver Shasta mine, Toodoggone District, B.C.

The samples tested responded very well to gold (“Au”) and silver (“Ag”) recoveries by conventional flotation, direct cyanidation and a combination of flotation and cyanidation treatments, which is similar to the historical processing flowsheet used at the Baker mill. Some of the gold occurs as coarse nugget grains which are amenable to gravity concentration.

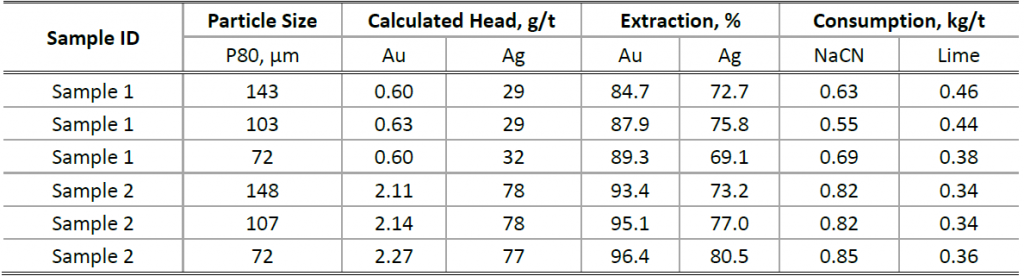

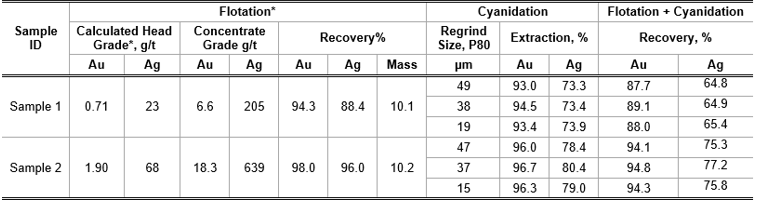

Direct cyanidation achieved extraction percentages of 84.7% to 96.4% for Au, and 69.1% to 80.5% for Ag (see Table 1). Flotation testing delivered recoveries to concentrate of 94.3% and 98.0% for Au, and 88.4% and 96.0% for Ag (see Table 2). Flotation concentrate regrinding and cyanidation delivered recoveries of 87.7% to 94.8% for Au, and 64.8% to 77.2% for Ag.

Fletcher Morgan, TDG’s CEO, commented: “These initial metallurgical results are absolutely in line with the recoveries indicated in the historical mill records when ore from Shasta was last processed through the Baker mill in 2012. The key difference is that much higher-grade material was processed historically, so it’s positive to see good recoveries achieved using conventional processing on the medium and lower-grade gold-silver mineralization that we drilled in 2021. This is an important step forward for TDG in revisioning Shasta as a bulk tonnage opportunity. We expect to continue metallurgical analysis this year to assist our drill targeting and resource definition work at Shasta.”

The samples were labelled as Sample #1 and Sample #2, respectively. Figure 1 below shows the drillhole locations in the deposit.

Previous Operation

Ore from the Shasta deposit was intermittently processed at Baker mill between 1989-1991 and 2008-2012 before the mill was put under care and maintenance. The Baker mill was originally designed to process the mill feeds from the Baker mine at a mill feed rate of 100 short tons per day (st/d). The mill consisted of two stages of crushing and one stage of ball mill grinding. The Au and Ag recovery processing flowsheet used at the early stage of the operation was a whole-ore cyanide leaching followed by Merrill Crowe treatment to recover Au and Ag from the leaching solution. Due to changes in mineralogical property in the late operation, the processing flowsheet was modified by incorporating a flotation pre-concentration circuit to recover gold and gold-bearing minerals into a flotation concentrate, which was further treated by cyanide leaching and Merrill Crowe process to recover Au and Ag from the concentrate. The flotation tailings bypassed the cyanide leaching circuit and was disposed, together with the leach residue, to the tailings storage facility (“TSF”). The mill feed rate was increased to approximately 200 tonnes per day (t/d).

2021-2022 Metallurgical Test Work

Flotation

The flotation test results indicate that the two samples responded well to the flotation procedure at a coarse primary grind size of 80% passing approximately 200 µm. The gold recovery reporting to rougher flotation concentrates ranged from 97.2% to 99.0% for Sample #2 and 93.3% to 97.2% for Sample #1 at different primary grind sizes, ranging from approximately 80% passing (P80) 72 µm to 209 µm. The average silver recoveries to the rougher flotation concentrates were 90.3% for Sample #1 and 96.4% for Sample #2.

Direct Cyanidation

The cyanide leach test results show both Sample #1 and Sample #2 responded well to the direct cyanidation. The average gold extraction rates were 87.3% for Sample #1 and 95.0% for Sample #2. On average the silver extraction rates were 72.5% for Sample #1 and 76.9% for Sample #2. The test results also indicate that the cyanide leaching kinetics were relatively rapid, approximately more than 70% and 50% of the Au were respectively extracted from Sample #1 and Sample #2 within a leaching retention time of 7 hours. A total leach retention time is 48 hours. The test results are summarized in Table 1.

Table 1: Direct Cyanidation Results – Head Samples

The reagent consumptions are generally at reasonable levels. The average sodium cyanide (NaCN) consumptions were 0.62 kilograms per tonne (“kg/t”) and 0.83 kg/t respectively for Sample #1 and Sample #2. The average hydrated lime (Ca(OH)2) consumptions were low, at 0.43 kg/t for Sample #1 and 0.35 kg/t for Sample #2 separately.

Flotation + Cyanidation

Using the bulk flotation procedure developed from the flotation tests, gold bearing bulk concentrates were produced from 20 -kg head samples at a primary grind size of 80% passing 200 µm. The concentrates were then reground at three different particle sizes, ranging from 80% passing 15 µm to 49 µm and then cyanide leached for 48 hours at a sodium cyanide concentration of 2 grams per litre (“g/L”). The test results are shown in Table 2.

Table 2: Flotation + Flotaion Concentrate Regrinding and Cyanidation

In general, the reground flotation concentrate responded well to the cyanidation. In the tested regrind size range, the gold and silver extractions were not sensitive to the regrind size. On average, Au and Ag extractions were approximately 93.6% Au and 73.5% Ag for the Sample #1’s concentrate and 96.3% Au and 79.2% Ag for the Sample #2’s concentrate. Overall, Au and Ag recoveries (flotation + cyanidation) are calculated to be 88.3% Au and 65.0% Ag for Sample #1 and 94.4% Au and 76.1% Ag for Sample #2, respectively. The test results show that reagent consumptions, including sodium cyanide, are at the reasonable levels.

Gravity Concentration

Gravity concentration testing was conducted on each of the two samples using two-pass centrifugal concentration followed by panning on the concentrates produced from the centrifugal concentration. The test results indicate that the two samples may contain free nugget Au grains, especially for Sample #2. Approximately 37.6% of the Au and 12.8% of the Ag in Sample #2 were concentrated into the pan concentrate containing 349.7 grams per tonne (“g/t”) Au and 4,816 g/t Ag. Compared to Sample #2, Sample #1 appears less responsive to the gravity concentration procedure with only 15.9% of the gold recovered into the pan concentrate with 48.3 g/t Au and 892 g/t Ag.

Grindability

The Bond ball mill work index was measured to be 16.4 kilowatt hour per tonne (“kWh/t for Sample #2 and 17.4 kWh/t for Sample #1, which are classified as moderate hardness to ball mill grinding.

Further Test Work

In 2022, TDG plans to undertake further metallurgical testing of various mineral samples, especially the samples representative to different lithological and alteration domains and spatial locations. Tetra Tech Canada Inc. is engaged to conduct the analysis for the preliminary metallurgical test results achieved from the samples of the Shasta deposit. The metallurgical test work was conducted by Bureau Veritas Minerals (BVM) Metallurgical Division, an accredited facility located in British Columbia, Canada.

Qualified Person

The technical content of this news release has been reviewed and approved by Dr. Huang, Ph.D., P.Eng., independent metallurgical consultant, a qualified person, as defined by National Instrument 43-101.

This news release includes historical drilling information that has been reviewed by the Company’s geological team. The Company’s review of the historical records and information reasonably substantiate the validity of the information presented in this news release; however, the Company cannot directly verify the accuracy of the historical data, including the procedures used for sample collection and analysis. Therefore, the Company encourages investors to exercise appropriate caution when evaluating these results. Further data review is underway, in order to verify the validity of the data for the anticipated NI 43-101 compliant mineral resource estimate.

About TDG Gold Corp.

TDG is a major mineral claim holder in the historical Toodoggone Production Corridor of north-central British Columbia, Canada, with over 23,000 hectares of brownfield and greenfield exploration opportunities under direct ownership or earn-in agreement. TDG’s flagship projects are the former producing, high grade gold-silver Shasta, Baker and Mets mines, which are all road accessible, produced intermittently between 1981-2012, and have over 65,000 m of historical drilling. In 2021, TDG advanced the projects through compilation of historical data, new geological mapping, geochemical and geophysical surveys, and, for Shasta, drill testing of the known mineralization occurrences and their extensions. TDG currently has 96,343,142 common shares issued and outstanding.

ON BEHALF OF THE BOARD

Fletcher Morgan

Chief Executive Officer

For further information contact:

TDG Gold Corp.,

Telephone: +1.604.536.2711

Email: info@tdggold.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains forward-looking statements that are based on the Company’s current expectations and estimates. Forward-looking statements are frequently characterized by words such as “plan”, “expect”, “project”, “intend”, “believe”, “anticipate”, “estimate”, “suggest”, “indicate” and other similar words or statements that certain events or conditions “may” or “will” occur. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that could cause actual events or results to differ materially from estimated or anticipated events or results implied or expressed in such forward-looking statements. Such factors include, among others: the actual results of current exploration activities; conclusions of economic evaluations; changes in project parameters as plans to continue to be refined; possible variations in ore grade or recovery rates; accidents, labour disputes and other risks of the mining industry; delays in obtaining governmental approvals or financing; and fluctuations in metal prices. There may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise. Forward-looking statements are not guarantees of future performance and accordingly undue reliance should not be put on such statements due to the inherent uncertainty therein.