Kismet Resources Announces Qualifying Transaction

VANCOUVER, July 29th, 2020

Kismet Resources Corp. has entered into a letter of intent (LOI) dated July 23, 2020, with TDG Gold Corp., a mineral exploration company with binding agreements to acquire four properties in the Toodoggone district of northeastern British Columbia, Canada, including the past-producing high-grade Baker and Shasta gold-silver mines and the Oxide Peak exploration-stage property. The LOI outlines the principal terms and conditions which will result in a reverse takeover of Kismet by TDG Gold (the “Transaction”).

Kismet is a Capital Pool Company and intends for the Transaction to constitute its Qualifying Transaction, as such terms are defined in the policies of the TSX Venture Exchange (the “TSXV”). In connection with the announcement of the LOI, the trading in the common shares of Kismet (“KismetShares”) has been halted pursuant to the policies of the TSXV. Trading will remain halted until, among other things, Kismet completes certain regulatory filings in connection with the Qualifying Transaction with the TSXV and the TSXV has completed certain matters it considers necessary or advisable.

About TDG Gold

TDG Gold was incorporated pursuant to the Business Corporations Act (British Columbia) on July 22, 2011. TDG Gold currently has 35,560,897 common shares (the “TDG Gold Shares”) issued and outstanding and has no options, warrants or other classes of securities outstanding. Management of TDG Gold currently owns approximately 33% of the TDG Gold Shares in aggregate and a BC subsidiary of OceanaGold Corporation, an international company listed on the ASX, currently owns approximately 18% of the TDG Gold Shares.

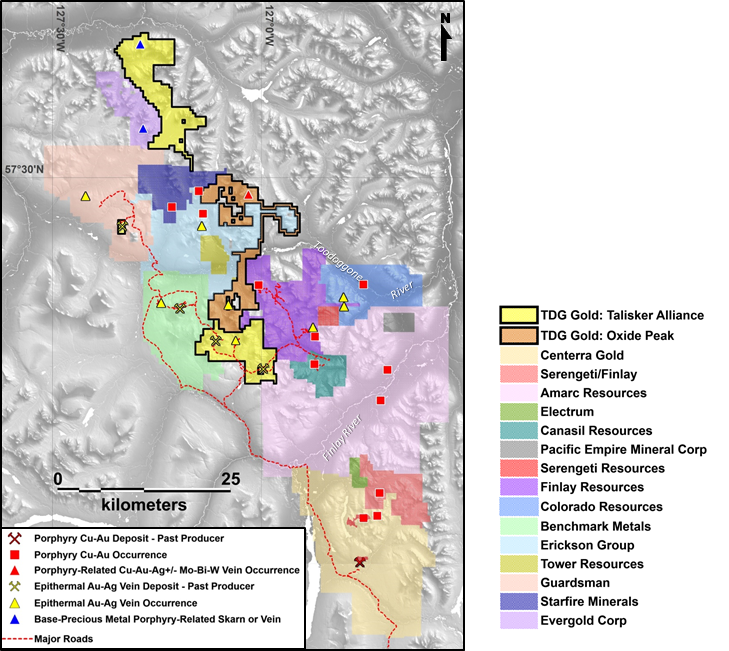

TDG Gold has binding agreements to acquire over 23,000 hectares in the Toodoggone District of northeastern British Columbia. The Toodoggone District is a 100 x 30 km belt (3000sq.km) with past producing mines and advance-stage exploration projects (see Fig 1) characterized by extensive gossans and alteration halos. Historic exploration and production focused on high-grade gold-silver epithermal deposits including the Baker, Shasta and Lawyers Mines. The property also has the potential to host copper-gold porphyry mineralization.

Baker-Shasta Mines

In July 2020, TDG Gold signed an asset purchase agreement (the “Asset Purchase Agreement”) to acquire (the “Asset Acquisition”) the Toodoggone assets of Talisker Resources Ltd. (“Talisker”) including the former producing Baker and Shasta Mines, the Baker mill, camp and tailings storage facility, and the Bot and Mets Properties. Both Baker and Shasta operated intermittently from the 1980 until the 2000s. During that period Baker produced over 77,500 tonnes at an average grade of 15gpt Au and 288 gpt Ag; and Shasta produced over 141,500 tonnes at an average grade of 4.48 gpt Au and 239.5 gpt Ag. Both mines are currently on reclamation status.

In addition to the potential for expanding on the historical Baker and Shasta mines, there are 5 early-stage exploration targets on the property with the potential for new discoveries:

- Black Gossan: Strong oxidized pyritic and gossanous alteration forms a prominent supergene cap

- Dave Price: Siliceous sericite-pyrite brecciated vein hosted in a ~600 m in diameter clay-alunite cap

- Castle Mountain: Skarn mineralization with anomalousgold, silver and lead in rock samples

- Pau: Anomalous Au-Ag bearing veins, breccias, and silicified zones

- Silver Reef: Anomalous Au-Ag quartz vein stockwork

The transaction with Talisker is subject to certain conditions including TDG Gold achieving a public listing on a Canadian stock exchange and total minimum capital raises of $5,000,000. In addition, Talisker will receive a minimum of 30.12% of the Resulting Issuer Shares (as defined below) on a fully diluted basis at listing and will have an Investor Rights Agreement allowing them, amongst other things, representation on the TDG Gold Board of Directors whilst their ownership remains greater than 10% of TDG Gold’s issued and outstanding shares.

Oxide Peak

In December 2019, TDG Gold signed an earn-in agreement with Arcwest Exploration Inc. (“Arcwest”) to acquire up to an 80% interest in its Oxide Peak exploration project (“Oxide Peak”). Oxide Peak is an 8,437 hectare exploration stage property situated in the northern part of the Toodoggone gold-copper district in British Columbia. Oxide Peak contains multiple undrilled zones of copper-gold mineralization that have yet to undergo systematic mapping and geophysical surveys, in addition to zones of strong gold-in-stream sediment anomalies that have yet to be traced to source.

TDG Gold may earn up to a 60% interest in Oxide Peak subject to the satisfaction of certain conditions including incurring minimum exploration expenditures of $2,400,000 over a three year period. TDG Gold’s first year exploration expenditure is $400,000 which is fully funded and the fieldwork component of the program is on schedule to be completed by the end of September 2020 (timing may be impacted by the continued spread of COVID-19).

If TDG Gold completes the 60% earn-in, it may earn an additional 20% interest (80% ownership in total) by completing a preliminary economic assessment. From that point, TDG Gold and Arcwest will form a joint venture in which each party will proportionately finance or dilute. Should TDG Gold’s or Arcwest’s interest be diluted to less than 10%, then that interest will convert to a 2% net smelter return royalty, of which 1% of the royalty can be bought back for a $2,000,000 cash payment.

Active Community Engagement

TDG Gold is proud to have the opportunity to undertake mineral exploration in the traditional territories of the Tahltan, Kwadatcha, Tsay Keh Dene and Takla First Nations. TDG Gold views itself as a co-steward of the land and is engaging in early, active and respectful dialogue with representatives of each community. In June 2020, TDG Gold commissioned Falkirk Environmental Consulting Ltd. to facilitate its engagement with Indigenous communities and also in June 2020, TDG Gold signed a communications agreement with the Tahltan Nation.

Capital Structure of TDG Gold

TDG Gold currently has 35,560,897 TDG Gold Shares outstanding and has no options, warrants or other classes of securities outstanding. It is expected that immediately prior to closing of the Transaction, there will be approximately 74,088,942 TDG Gold Shares issued and outstanding.

Summary of the Transaction

It is currently anticipated that Kismet will acquire TDG Gold by way of a three-corner amalgamation, share exchange, plan of arrangement or other similar form of transaction as agreed by the parties to ultimately form the resulting issuer (the “Resulting Issuer”). The final structure of the Transaction is subject to the receipt of tax, corporate and securities law advice for both Kismet and TDG Gold. Upon completion of the Transaction, the Resulting Issuer will carry on the business of TDG Gold.

Pursuant to the Transaction, holders of issued and outstanding TDG Gold Shares will receive 0.6667 (two thirds) Kismet Shares (the “Pre-Consolidation Shares”) for each TDG GoldShare (the “Exchange Ratio”) held by them.

As a condition to closing the Transaction, concurrently with, or immediately prior to the closing of the Transaction, Kismet will undertake a share consolidation (the “Consolidation”). The Consolidation will occur on the basis of one (1) post-Consolidation Kismet Share (“Kismet Consolidated Shares”) for every two (2) Pre-Consolidation Kismet Shares. Upon completion of the Transaction, approximately 60 million KismetConsolidated Shares will be issued and outstanding and will represent all of the issued and outstanding common shares (the “Resulting Issuer Shares”) of the Resulting Issuer.

It is expected that Kismet will effect a name change to “TDG Gold Corp.” (the “Name Change”) upon the completion of the Transaction.

Upon completion of the Transaction, it is expected that the former shareholders of TDG Gold will hold approximately 40.96% of the Resulting Issuer Shares, Talisker will own approximately 33.6% of the Resulting Issuer Shares, the placees of the Concurrent Equity Offering (as defined below) will own approximately 22.12% of the Resulting Issuer Shares and that the former shareholders of Kismet will hold approximately 3.32% of the Resulting Issuer Shares, all on an undiluted basis. The foregoing percentage interests in the outstanding Resulting Issuer Shares are an estimate only, based on management’s current expectations, and are contingent on a number of factors, including the final pricing and size of the Concurrent Equity Offering.

Closing of the Transaction will be subject to a number of conditions precedent, including, without limitation:

- a) completion of the Asset Acquisition by TDG Gold pursuant to the terms of the Asset Purchase Agreement immediatelyprior to the closing of the Transaction;

- b) completion of the Concurrent Equity Offering;

- c) TSXV acceptance of the Transaction as the Qualifying Transaction of Kismet;

- d) the Resulting Issuer meeting the initial listing requirements as a Tier 2 issuer under the rules and policies of the TSXV;

- e) completion by the Resulting Issuer of the Consolidation on the Closing Date;

- f) completion of mutual satisfactory due diligence investigations of TDG Gold and Kismet;

- g) approval of the Transaction by the boards of directors of TDG Gold and Kismet;

- h) execution of a definitive agreement effecting the Transaction;

- i) receipt of all regulatory approvals with respect to the Transaction and the listing of the Resulting Issuer Shares on theTSXV; and

- j) approval of the Transaction by TDG Gold shareholders.

It is anticipated that the Resulting Issuer will qualify as a Tier 2 Mining Issuer pursuant to the requirements of the TSXV.

The Transaction is not a Non-Arm’s Length Qualifying Transaction (as such term is defined in the policies of the TSXV) and consequently the Transaction will not be subject to approval by Kismet’s shareholders. However, Kismet does plan to hold an annual general and special meeting of shareholders whereat, among other things, the shareholders of Kismet will be asked to approve certain matters including but not limited to the appointment of a new slate of directors.

Concurrent Equity Offering

As per the LOI, it is anticipated that prior to or concurrently with the closing of the Transaction, Kismet or TDG Gold, as the case may be, will complete a private placement (the “Concurrent Equity Offering”) of units (each, a “Unit”), at a price per Unit to be determined in the context of the market, to raise gross proceeds of not less than $4,000,000.

Board of Directors and Management of the Resulting Issuer

It is proposed that the board of directors of the Resulting Issuer shall consist of five directors, including Evandra Nakano, CEO and director of Kismet, and four nominees of TDG Gold. Management of the Resulting Issuer shall be confirmed in due course.

Sponsorship for Qualifying Transaction

Sponsorship of a Qualifying Transaction of a capital pool company is required by the TSXV, unless exempt in accordance with TSXV policies. The Corporation intends to apply for an exemption from sponsorship in connection with the Qualifying Transaction in accordance with TSXV Policy 2.2.

Filing Statement

In connection with the Transaction and pursuant to the requirements of the TSXV, Kismet will file on SEDAR (www.sedar.com) a filing statement (or an information circular in the event that the Transaction requires approval by the shareholders of Kismet) which will contain details regarding the Transaction, Kismet, TDG Gold and the Resulting Issuer.

Further information

Kismet intends to issue a subsequent press release in accordance with the policies of the TSXV providing further details in respect of the Transaction, including information relating to the transaction structure and descriptions of the proposed directors and Insiders (as such term is defined in the policies of the TSXV) of the Resulting Issuer, as well as the Concurrent Equity Offering. In addition, a summary of TDG Gold’s financial information will be included in a subsequent news release.

Completion of the Transaction is subject to a number of conditions, including but not limited to, TSXV acceptance and if applicable pursuant to TSXV Requirements, majority of the minority shareholder approval. Where applicable, the Transaction cannot close until the required shareholder approval is obtained. There can be no assurance that the Transaction will be completed as proposed or at all.

Investors are cautioned that, except as disclosed in the management information circular or filing statement to be prepared in connection with the Transaction, any information release or received with respect to the Transaction may not be accurate or complete and should not be relied upon. Trading in the securities of a capital pool company should be considered highly speculative.

Qualified Person

David Hladky, P.Geo., a qualified person as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects and Director of Kismet Resources Corp., has reviewed and approved the scientific and technical disclosure in this press release.

We seek Safe Harbor.